Importance of Donor Acquisition Cost

The donor acquisition cost (DAC) measures how much a nonprofit spends to secure each new donor. It matters because acquisition is one of the most expensive parts of fundraising, and without careful monitoring, costs can erode the value of new contributions. Boards and fundraisers use this metric to evaluate the efficiency of campaigns and decide where to allocate resources. For nonprofits in social innovation and international development, where cultivating new institutional, diaspora, or grassroots donors may involve significant upfront investments, DAC provides a reality check on whether acquisition strategies are sustainable.

Definition and Features

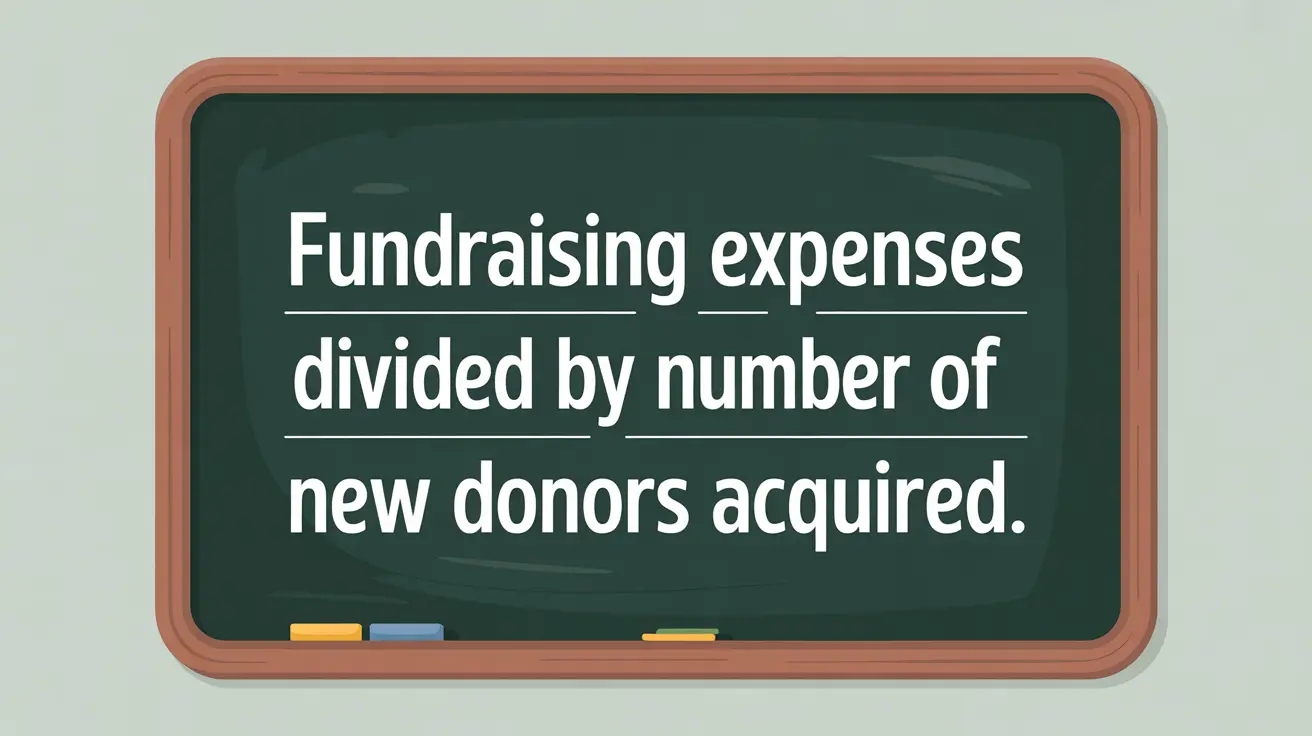

The donor acquisition cost is defined as:

Fundraising Expenses divided by the Number of New Donors Acquired.

Key features include:

- Efficiency Indicator: shows how much it costs to add each new donor to the base.

- Benchmark Use: varies widely; grassroots campaigns may have low DAC, while major donor or institutional cultivation often requires higher investment.

- Short- vs. Long-Term View: high acquisition costs may be justified if donors are retained for years.

- Strategic Link: must be balanced with donor retention rate and lifetime value.

How This Works in Practice

If a nonprofit spends $100,000 on a campaign and gains 500 new donors, its DAC is $200 per donor. Leadership then compares this to the average gift size and retention rate to assess whether the investment is worthwhile. For example, if new donors give an average of $500 annually and are retained for several years, the acquisition cost is well justified. International NGOs often accept higher DACs when entering new countries or donor markets, expecting returns over time as relationships strengthen.

Implications for Social Innovation

For nonprofits in social innovation and international development, DAC highlights the balance between investment and sustainability in donor growth. High costs may be necessary when cultivating complex partnerships or institutional funders, but boards must ensure that the long-term return outweighs the upfront expense. A low DAC, while appealing, may reflect shallow engagement if those donors do not stay. By analyzing DAC alongside retention and lifetime value, nonprofits can make smarter decisions about how to grow and sustain a donor base that supports systemic change and innovation.