Importance of Beginning Net Assets

Beginning net assets provide the financial starting point for a nonprofit at the start of a fiscal year. They represent the accumulated surpluses or deficits from prior years and serve as the foundation upon which current financial activity builds. For nonprofits in social innovation and international development, beginning net assets are especially important because they reflect historical financial stewardship, the organization’s ability to build reserves, and its capacity to weather future uncertainties. Donors, boards, and regulators use this figure to understand continuity: whether the nonprofit is building a stable base of resources or operating with thin or negative reserves. Beginning net assets set the stage for evaluating the change in net assets over the reporting period and, ultimately, the ending balance that reflects organizational sustainability.

Definition and Features

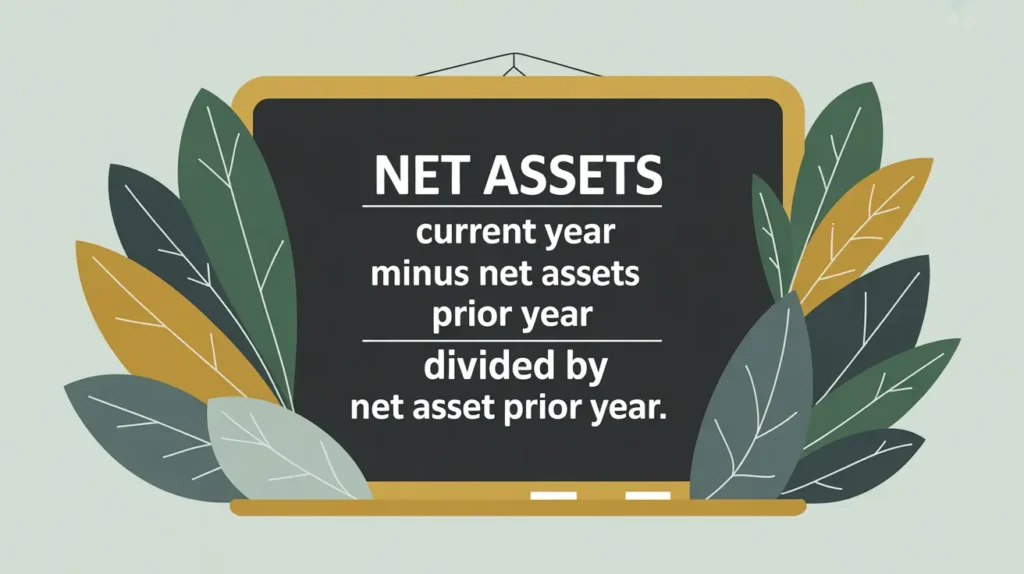

Beginning net assets are the total net assets carried forward from the prior fiscal year into the current year. They include both “without donor restrictions” and “with donor restrictions” balances. This figure is reported in the Statement of Activities as the starting point of the net asset reconciliation. It differs from revenues or contributions, which represent new inflows of resources, and from ending net assets, which reflect the cumulative position after current-year activity. Beginning net assets are not themselves a measure of performance but rather a starting balance used to track changes over time. They provide the continuity needed for financial statements to tell a coherent story year to year.

How This Works in Practice

In practice, beginning net assets are carried forward automatically in financial reporting systems from the prior year’s ending net assets. Finance teams must ensure that any prior period adjustments, audit findings, or corrections are accurately reflected before establishing the beginning balance. For example, if a nonprofit ended the prior year with $3 million in net assets $2 million without donor restrictions and $1 million with donor restrictions these amounts will appear as the beginning balances in the next year’s Statement of Activities. Boards and leadership often use beginning net assets as a benchmark, asking whether the organization is building reserves, depleting them strategically, or struggling to maintain balance. Lenders and donors may also review this figure to assess long-term sustainability and risk exposure.

Implications for Social Innovation

For nonprofits engaged in social innovation and international development, beginning net assets carry strategic implications beyond accounting continuity. A strong beginning balance provides flexibility to launch new initiatives, invest in infrastructure, or bridge funding gaps. Conversely, a weak or negative balance limits capacity and raises concerns about organizational viability. Clear reporting of beginning net assets reduces information asymmetry by showing stakeholders how past financial decisions have positioned the organization for future impact. It also contextualizes current-year results: a deficit may be manageable if reserves are strong, but alarming if reserves are thin. By understanding and communicating beginning net assets, nonprofits can reinforce trust, demonstrate prudent stewardship, and align financial capacity with ambitious social innovation goals.