Importance of the Working Capital Ratio

The working capital ratio assesses whether a nonprofit has enough net current resources to sustain operations relative to its expense base. Unlike the current or quick ratios, which compare assets to liabilities, this measure links liquidity directly to annual spending. This matters because it shows not just if bills can be paid, but how long an organization can operate before exhausting available net current assets. For nonprofits in social innovation and international development, the ratio helps boards and funders judge operational resilience in contexts where expenses are high and inflows may be delayed or restricted.

Definition and Features

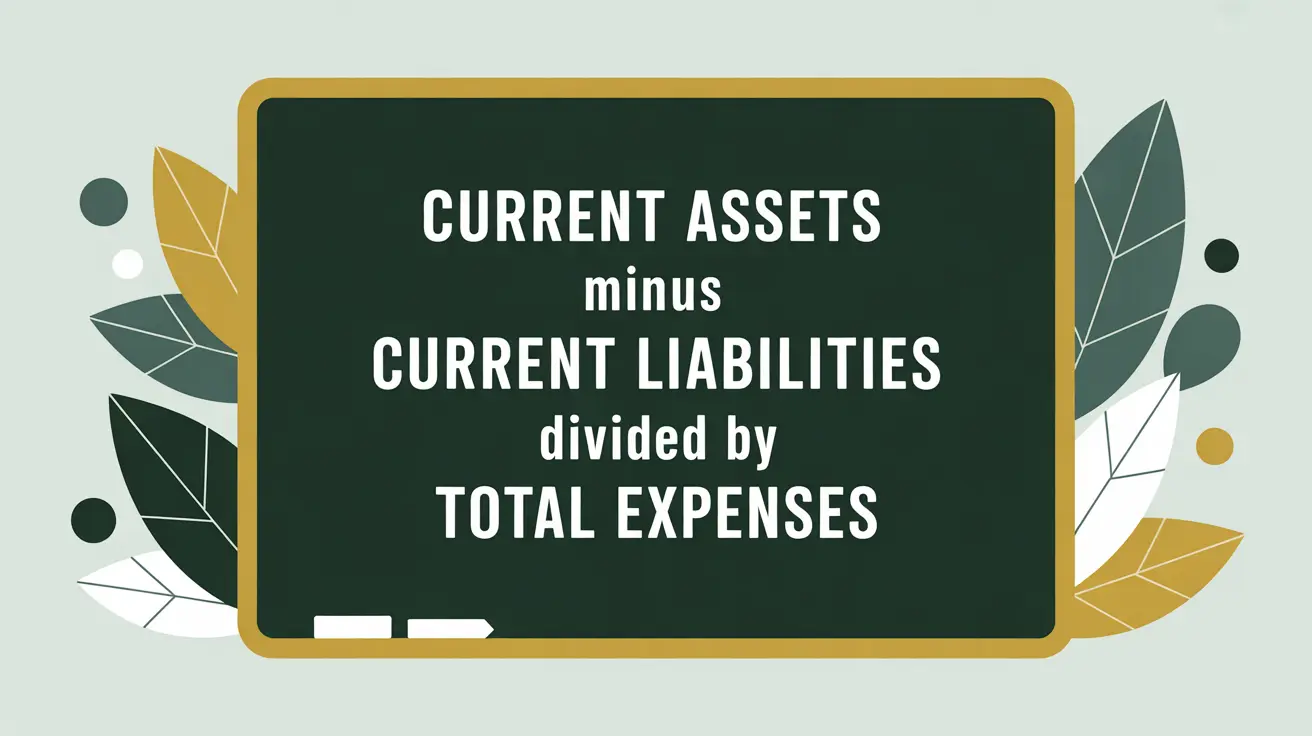

The working capital ratio is defined as:

Current Assets minus Current Liabilities divided by Total Expenses.

Key features include:

- Operational Cushion: shows whether an organization’s short-term net assets are sufficient to support ongoing programs.

- Expense-Linked: ties liquidity to scale of operations, not just liabilities.

- Benchmark Use: positive ratios indicate available cushion; negative ratios suggest liabilities exceed assets, raising sustainability concerns.

- Decision Relevance: helps boards set reserve policies in terms of months of operating coverage.

How This Works in Practice

If a nonprofit has $3 million in current assets, $2 million in current liabilities, and $12 million in total expenses, its working capital ratio is 0.083, or roughly one month of expenses. This signals the organization has limited margin for error if reimbursements are delayed. Finance committees use this ratio to assess whether reserves should be increased or spending moderated. For example, an international NGO might set a policy requiring at least 90 days of working capital coverage before committing to new multi-year projects.

Implications for Social Innovation

For nonprofits in social innovation and international development, the working capital ratio is a lens on operational resilience. It highlights whether the organization can continue paying staff, vendors, and field offices during funding delays or emergencies. A strong ratio signals to donors that the nonprofit can responsibly manage multi-donor portfolios without program disruption. A weak ratio, by contrast, may undermine credibility, making funders hesitate to award large, complex grants. By monitoring and managing working capital, organizations can make better strategic decisions about growth, reserves, and the timing of new initiatives.