Importance of Days Cash on Hand

Days Cash on Hand measures how many days a nonprofit can continue to operate if no new cash comes in. It translates liquidity into time, making it one of the most practical indicators for boards, donors, and managers. This matters because knowing how long the organization can “keep the lights on” directly informs decisions about reserves, fundraising urgency, and risk management. For nonprofits in social innovation and international development, where donor disbursements can be delayed or restricted, this measure is critical for planning continuity during funding gaps or crises.

Definition and Features

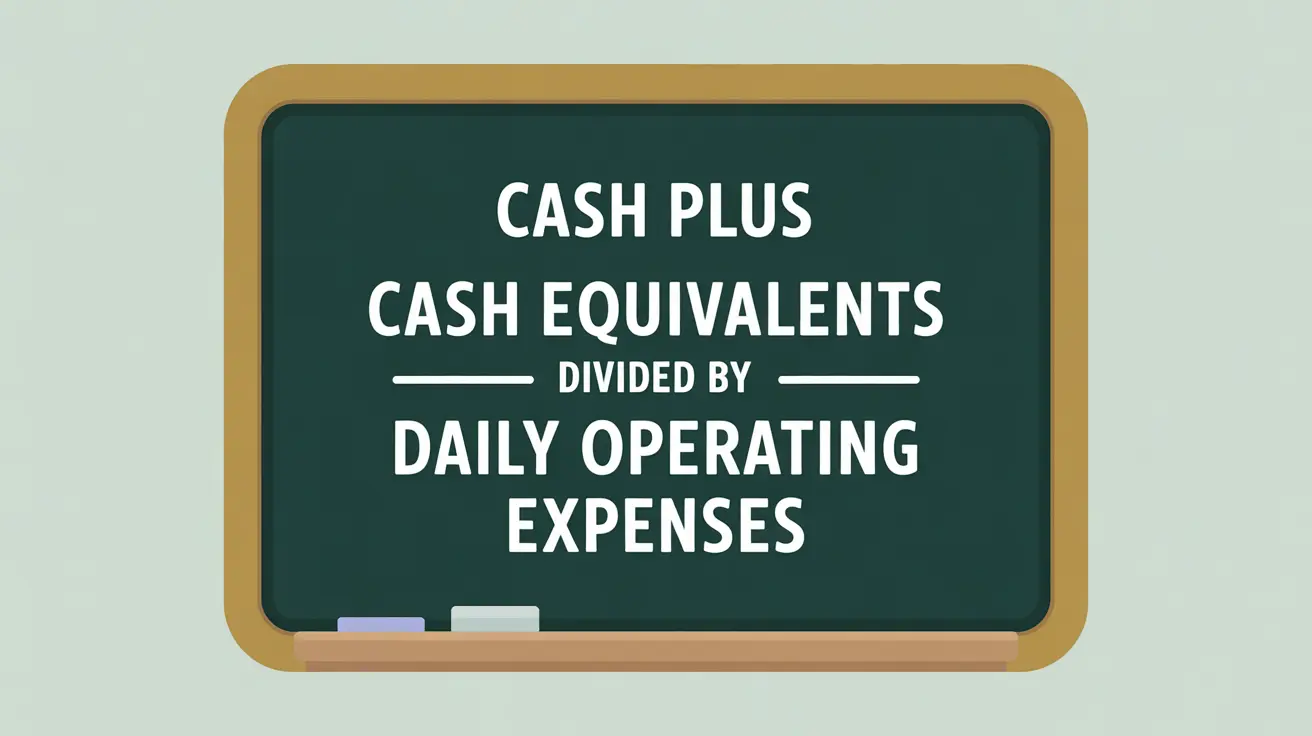

Days Cash on Hand is defined as:

Cash plus Cash Equivalents divided by Daily Operating Expenses.

Key features include:

- Time-Based Measure: expresses liquidity in days of operation rather than ratios.

- Crisis Planning Tool: highlights how long the organization can sustain itself without new revenue.

- Benchmark Use: 90 days is often cited as a strong standard, though benchmarks vary by size, model, and funding environment.

- Board Relevance: commonly used in setting reserve policies.

How This Works in Practice

If a nonprofit has $2 million in cash and annual operating expenses of $12 million, it spends roughly $33,000 per day. This means it has about 60 days of cash on hand. A finance committee reviewing this number may decide to delay launching a new initiative until reserves are strengthened. International NGOs often monitor days cash on hand across country offices, ensuring that field programs are not jeopardized by delayed reimbursements from government or multilateral donors.

Implications for Social Innovation

For nonprofits in social innovation and international development, days cash on hand is a resilience metric. It reassures donors that the organization can withstand disruptions (like delayed reimbursements, currency fluctuations, or unexpected crises) without halting essential services. Leaders use it to balance the trade-off between holding cash reserves for security and deploying resources quickly for impact. Donors may even require disclosure of days cash on hand as a condition for large grants. By managing this measure actively, nonprofits can both safeguard current operations and position themselves as credible stewards of complex, multi-year initiatives.