Importance of the Statement of Activities

The Statement of Activities, often referred to as the nonprofit equivalent of an income statement, is central to financial transparency and accountability in mission-driven organizations. In today’s funding environment, where donors, regulators, and communities increasingly expect clarity, this statement provides a structured picture of how resources are generated and used to advance social goals. Unlike for-profit income statements that emphasize profit, the nonprofit Statement of Activities emphasizes changes in net assets and the alignment of revenues with mission-related programs. For organizations operating at the intersection of social innovation and international development, this distinction matters. It demonstrates how funds flow across restricted and unrestricted categories and highlights stewardship over donor intent. Understanding this statement is essential not only for compliance but also for building trust with stakeholders and ensuring that limited resources are directed toward sustainable, impactful change.

Definition and Features

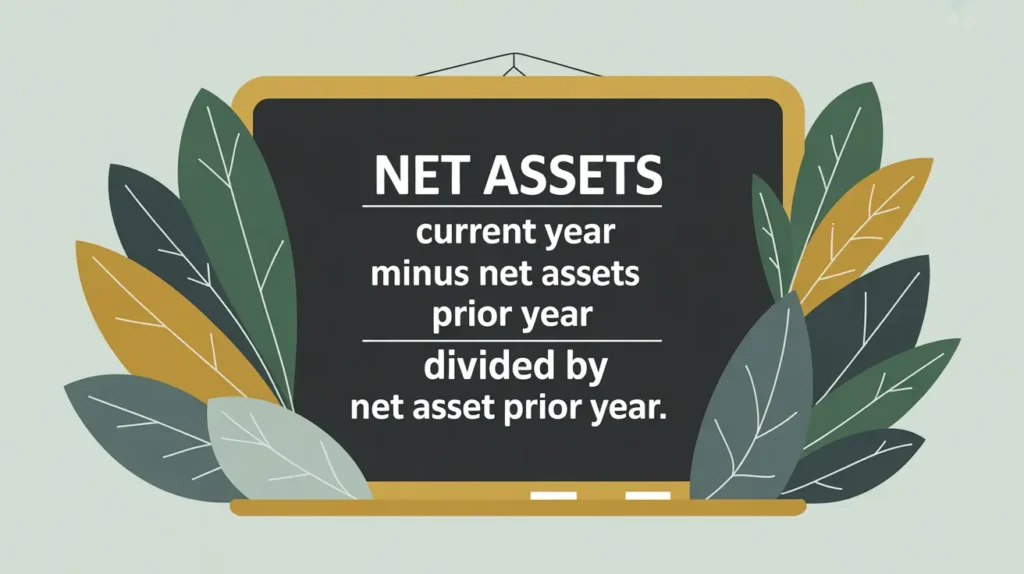

The Statement of Activities reports a nonprofit’s revenues, expenses, gains, losses, and resulting changes in net assets over a defined accounting period. It is required under generally accepted accounting principles (GAAP) in the United States and has analogs in international frameworks such as IFRS for nonprofits. The statement differs from a for-profit income statement in two important ways: it categorizes resources as “with donor restrictions” or “without donor restrictions,” and it emphasizes mission delivery over profitability. It does not show financial position (that belongs to the Statement of Financial Position) nor does it reflect cash flows (covered in the Statement of Cash Flows). Its purpose is to measure performance in advancing the organization’s mission through program, fundraising, and administrative activities. It is not a budget or projection document but rather a retrospective record of actual financial activity.

How this Works in Practice

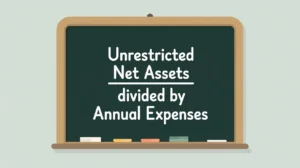

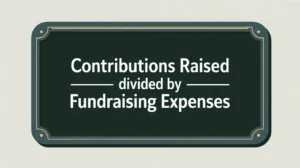

In practice, the Statement of Activities functions like a financial “waterfall.” It begins with revenue sources such as contributions, grants, program service revenue, investment income, and in-kind donations. Each source is recorded by restriction category and then aggregated into total revenues. On the expense side, the statement classifies outflows into program services, management and general, and fundraising. Netting expenses against revenues results in the change in net assets, essentially showing whether the organization ended the year with a surplus or deficit in each restriction category. Nonprofits often supplement the statement with functional expense disclosures, showing how much was spent on mission delivery relative to overhead. Analysts use the Statement of Activities to evaluate trends in revenue diversification, cost structure, and financial resilience. While the presentation can vary, the core principle is comparability: giving stakeholders a consistent framework to understand organizational performance.

Implications for Social Innovation

For organizations working in social innovation and international development, the Statement of Activities is a strategic communication tool. Donors look to it for evidence that funds are being used responsibly. Boards use it to make governance decisions, such as approving budgets and assessing program growth. Fundraisers rely on it to demonstrate efficiency and credibility to prospective supporters. In global development contexts, the statement also helps align financial reporting across different donor requirements, particularly when resources are received in multiple currencies or under varying restriction terms. By illuminating both the scale and direction of resources, the Statement of Activities helps stakeholders evaluate sustainability, efficiency, and impact. It reduces information asymmetry by translating financial data into a mission-driven narrative of stewardship and accountability, ultimately reinforcing trust in organizations tackling complex societal challenges.