Importance of the Stability Ratio

The stability ratio measures the degree to which a nonprofit’s operations are supported by unrestricted net assets relative to its total expenses. It matters because unrestricted funds are the most flexible, enabling organizations to pay for core infrastructure, bridge delays in restricted funding, and invest in innovation. For boards and donors, this ratio signals whether the nonprofit has the financial stability to withstand fluctuations in funding. In social innovation and international development, where most grants are highly restricted, a strong stability ratio reassures stakeholders that the organization can continue delivering programs even when donor rules limit how funds are spent.

Definition and Features

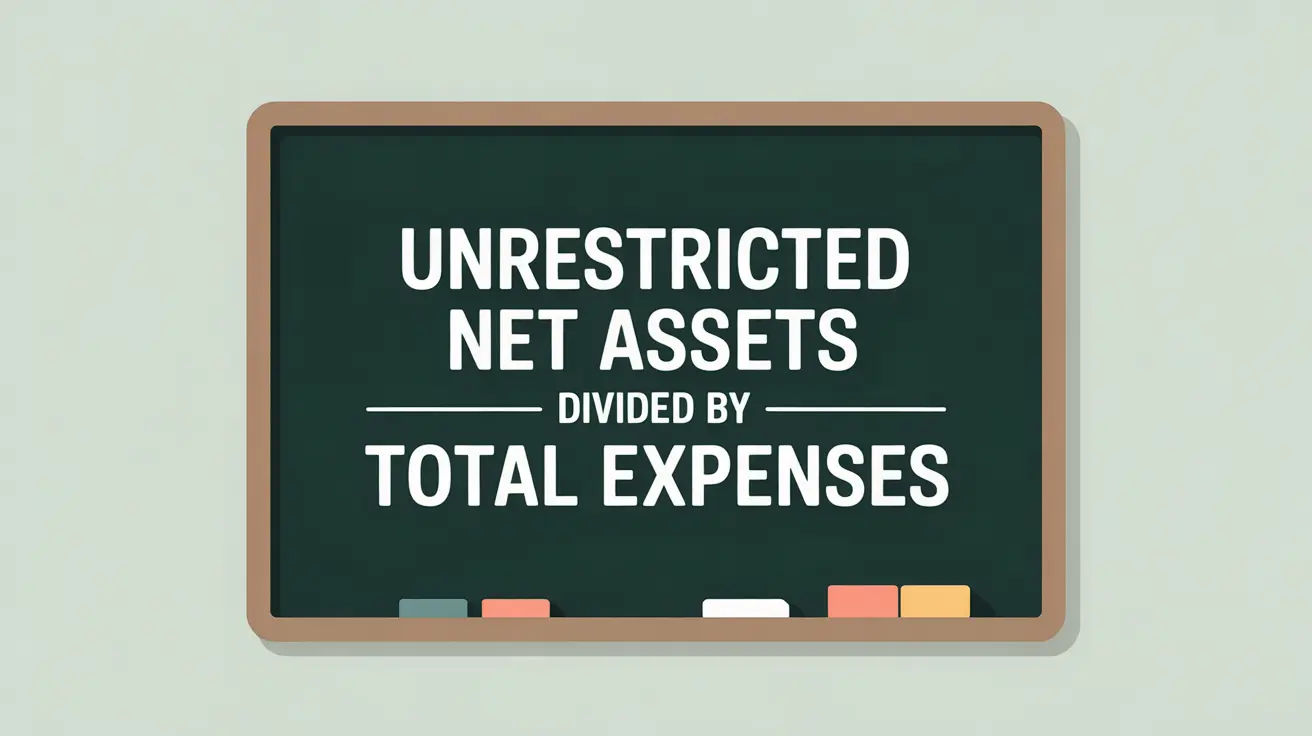

The stability ratio is defined as:

Unrestricted Net Assets divided by Total Expenses.

Key features include:

- Flexibility Measure: shows how much of operating costs can be supported by unrestricted resources.

- Benchmark Use: higher ratios indicate greater financial independence; very low ratios may point to fragility.

- Risk Management: highlights vulnerability to donor restrictions or funding cuts.

- Board Utility: helps guide policy around reserves and unrestricted fundraising.

How This Works in Practice

If a nonprofit has $2 million in unrestricted net assets and $10 million in total expenses, its stability ratio is 0.20, indicating it can cover 20% of its operating costs with unrestricted reserves. A board might interpret this as sufficient cushion for flexibility, while also noting the need to grow unrestricted revenue sources. For an international NGO dependent on restricted donor contracts, a stability ratio below 0.1 could be a red flag, prompting efforts to increase core support from foundations or diversify revenue through social enterprise.

Implications for Social Innovation

For nonprofits in social innovation and international development, the stability ratio underscores the importance of unrestricted support in driving innovation and adaptability. Donors increasingly recognize that organizations cannot scale or sustain systemic change if they lack flexible funding. A strong ratio helps nonprofits negotiate with funders from a position of strength, showing they are not entirely captive to restricted rules. A weak ratio may limit the ability to invest in monitoring, technology, or partnerships, which are critical elements in innovation. By improving this ratio, nonprofits build both credibility and capacity for long-term impact.