Importance of Prepaid Expenses

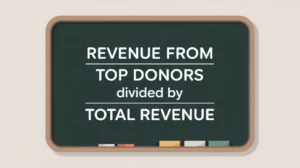

Prepaid expenses are an important aspect of nonprofit financial management because they reflect payments made in advance for goods or services that will benefit future periods. While they do not provide liquidity like cash, they do indicate resources that have already been secured, reducing future cash outflows. For nonprofits in social innovation and international development, prepaid expenses help stabilize operations by ensuring that essential costs such as rent, insurance, or subscriptions are covered ahead of time. They also support financial planning by smoothing cash flow and preventing service disruptions. Understanding prepaid expenses helps donors, boards, and managers see how resources are allocated across time and how operational stability is maintained.

Definition and Features

Prepaid expenses are defined as advance payments for goods or services to be received in future periods. Common examples include prepaid rent, insurance premiums, conference fees, or software subscriptions. In accounting, these payments are recorded as current assets on the Statement of Financial Position because they represent future economic benefit. As the benefit is realized (for example, each month of a prepaid annual insurance policy) the expense is gradually recognized in the Statement of Activities, and the prepaid balance decreases. Prepaid expenses differ from regular expenses, which are recorded when incurred, and from deposits, which may be refundable rather than amortized over time.

How This Works in Practice

In practice, nonprofits often use prepaid expenses to manage predictable costs and reduce financial risk. For example, paying for a year of liability insurance upfront may secure a discounted rate while ensuring uninterrupted coverage. Finance teams record the initial payment as a prepaid asset, then systematically allocate portions of the expense each month. Proper tracking is essential to prevent misstating expenses or overstating assets. Prepaid expenses are also a tool for cash flow management: while they reduce cash available in the short term, they provide stability by locking in future services. Auditors frequently review prepaid balances to confirm that expense recognition aligns with the periods benefited.

Implications for Social Innovation

For nonprofits engaged in social innovation and international development, prepaid expenses reinforce operational continuity in environments where funding and logistics can be unpredictable. Prepaying for housing, transport, or technology services may be critical in field projects to ensure smooth delivery of programs. Transparent reporting of prepaid expenses reduces information asymmetry by clarifying how much of an organization’s resources are tied up in future benefits rather than available for immediate use. Donors and boards can then better assess liquidity, sustainability, and risk exposure. By managing prepaid expenses effectively, nonprofits demonstrate foresight and prudent financial stewardship, ensuring that core infrastructure is secured in support of mission-driven impact.