Importance of Total Expenses

Total expenses provide a comprehensive view of how a nonprofit allocates and utilizes its financial resources over a given period. They represent the sum of all costs, including program, management and general, and fundraising. Total expenses serve as a cornerstone for evaluating organizational efficiency and sustainability. For stakeholders in social innovation and international development, understanding total expenses is crucial for assessing whether an organization is balancing mission delivery with the infrastructure and fundraising required to sustain impact. As donors, boards, and regulators increasingly demand transparency, total expenses function as both a performance measure and a trust-building tool, showing how resources flow through the organization as a whole.

Definition and Features

Total expenses are defined as the aggregate of all costs incurred by a nonprofit during a reporting period, typically presented in the Statement of Activities and the Statement of Functional Expenses. They include direct program expenses, administrative costs, and fundraising expenditures. Unlike line-item categories, which show specific functions, total expenses provide a holistic figure that stakeholders can use to compare organizations of different sizes or to evaluate trends over time. They differ from liabilities, which reflect obligations, and from net assets, which reflect accumulated equity. Accounting standards require accurate classification and reporting of each component, ensuring that total expenses reflect a true and fair picture of the organization’s cost structure.

How This Works in Practice

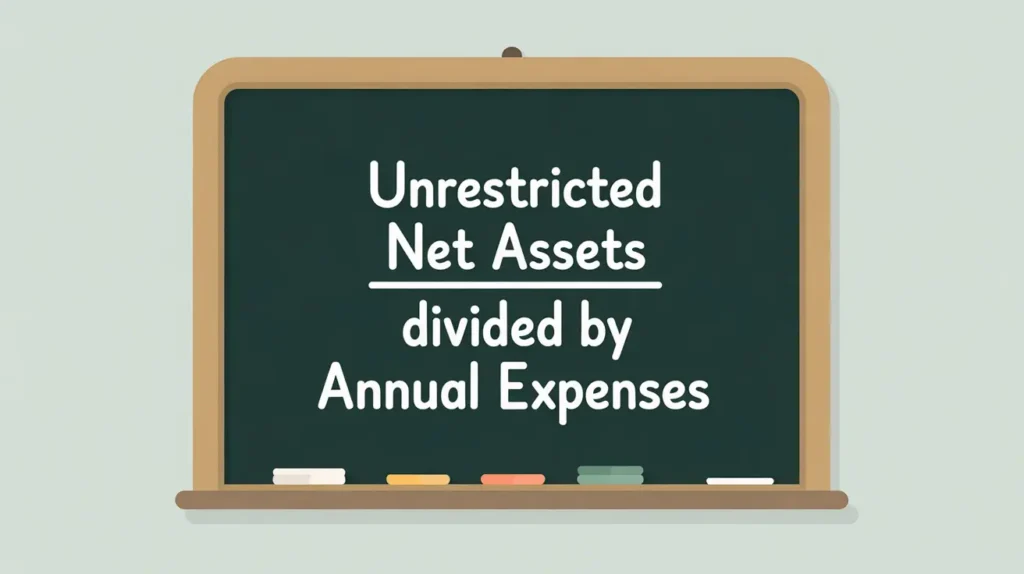

In practice, nonprofits calculate total expenses by summing all classified costs from functional categories. Finance teams ensure proper allocations, such as dividing shared expenses like rent or technology across program, fundraising, and management categories. Total expenses are then compared to revenues to assess whether the organization is operating at a surplus or deficit. This figure is also used in efficiency ratios, such as program expense ratio or fundraising expense ratio, which rely on total expenses as the denominator. Misstating or misallocating expenses can distort total expenses, potentially misleading funders or regulators. Beyond compliance, tracking total expenses allows organizations to evaluate cost growth, identify inefficiencies, and make informed strategic choices about scaling programs or investing in infrastructure.

Implications for Social Innovation

For nonprofits engaged in social innovation and international development, total expenses carry strategic weight. They reveal whether organizations are achieving scale responsibly, balancing investment in innovation with sustainable cost structures. Donors often examine total expenses alongside program versus overhead ratios to gauge credibility, while boards use them to benchmark progress and make governance decisions. In multi-country or multi-donor contexts, clear reporting of total expenses reduces information asymmetry, ensuring funders understand the full financial footprint of mission activities. By contextualizing total expenses as an integrated view of mission delivery, nonprofits can better communicate the true cost of achieving impact. It is an important way to reinforce trust and support long-term sustainability.